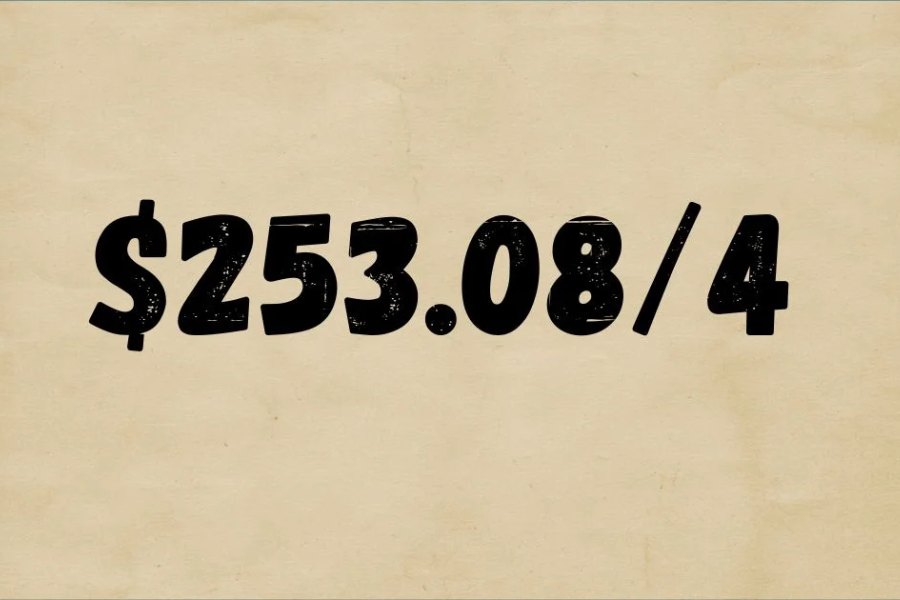

Unpacking the Power of $253.08/4: A Financial Insight

Ever come across a number that seems ordinary but holds unexpected financial potential? Enter $253.08/4. This specific figure may seem random, but it has the potential to reshape how you view budgeting, saving, and financial habits. More than just a sum, it represents a structured approach to financial discipline that anyone can leverage.

In a world where every dollar counts, understanding the value of $253.08/4 could be a game-changer. Let’s dive into the backstory of this number, its financial significance, and how you can use it to build a stronger financial future.

Origin of $253.08/4

The journey of $253.08/4 has its roots in various budgeting practices designed to simplify money management. Perhaps it originated as a regular monthly savings figure or from a calculated budget for essential expenses. Numbers like these serve as benchmarks that bring awareness to our spending habits and remind us of the importance of setting aside funds for the future.

As financial planning became a more structured practice, specific figures like $253.08 became focal points in budgeting. This amount reflects how a single number, applied consistently, can help us build financial security and develop the discipline needed to manage our finances effectively.

The Importance of Budgeting and Saving

Budgeting and saving are essential for anyone seeking financial wellness. They offer the structure needed to make informed spending choices, avoid unnecessary debt, and prepare for unexpected expenses. Without a solid strategy, it’s easy to fall into overspending and miss out on opportunities for growth.

When you have a clear budget, you gain insight into your financial habits. It allows you to make adjustments where needed, often revealing areas to cut back and save more. Regular savings, however small, provide a cushion that brings peace of mind during emergencies or job transitions and supports long-term goals, such as retirement or purchasing a home.

Prioritizing budgeting and saving now is like investing in future security. It’s about recognizing the value of each dollar, developing financial awareness, and fostering habits that lead to lasting independence.

Applying $253.08/4 to Your Finances

Incorporating $253.08/4 into your budget might seem minor, but over time, it can make a huge difference. This amount breaks down to about $63.27 per week, a manageable figure for many. By setting this aside consistently, you could allocate it toward several financial goals.

Consider designating this amount to your savings or an investment account. Small, regular contributions add up significantly, especially when compounded over the years. Alternatively, you could direct $253.08/4 toward debt reduction. Targeting high-interest loans with this sum each month can help you pay less in interest overall.

Another approach is using $253.08/4 for specific personal goals—such as saving for a vacation or home upgrades. Breaking it down into weekly portions makes it feel more achievable and keeps you motivated toward your goals.

Tracking your progress using budgeting apps can make this even easier. Many tools allow you to monitor your spending and savings, helping you stay on track and make adjustments as needed.

Real-World Stories of $253.08/4 Success

Take Sarah, a recent college graduate who used the $253.08/4 approach to manage her living expenses. By dedicating this amount to essentials like groceries and transportation, she kept her spending in check and saved for unexpected expenses.

Mike, a small business owner, took this strategy and allocated $253.08 each month toward marketing. Over a year, this consistent investment helped grow his business, attracting more clients and generating a solid return on his investment.

Rachel, facing significant credit card debt, applied $253.08/4 toward her balance each month. With this disciplined approach, she steadily reduced her debt and boosted her credit score, achieving greater financial freedom.

Even families can find value in this approach, using $253.08 each month to fund an emergency account or save for a family getaway. It’s a straightforward method that gradually shifts how you manage money, helping you achieve goals without straining your budget.

Alternative Strategies to $253.08/4

While $253.08/4 can be effective, other financial strategies might better suit your needs and goals.

The 50/30/20 Rule: This popular budgeting method divides income into three categories: 50% for necessities, 30% for wants, and 20% for savings or debt repayment. It’s a flexible, easy-to-follow guideline that provides structure while adapting to different financial situations.

Automated Savings: Numerous apps can automatically set aside small amounts for you, making it easy to save without focusing on specific figures. Automated savings can be an effective alternative to traditional budgeting for those who prefer a hands-off approach.

Zero-Based Budgeting: This technique assigns every dollar a purpose, making you more mindful of each spending decision. By planning out your income dollar by dollar, you ensure all expenses and savings goals are accounted for each month.

Emergency Fund: Instead of focusing on a specific monthly figure, consider building an emergency fund that covers three to six months of living expenses. This flexibility provides a safety net for any unplanned financial challenges.

Final Thoughts

The concept of $253.08/4 goes beyond a simple number; it’s an invitation to rethink financial planning in practical terms. By incorporating this figure into your budget, you’re likely to experience a clearer view of your finances, more disciplined spending habits, and peace of mind about the future.

Real-life examples demonstrate the significant impact this amount can have, whether you’re saving, paying down debt, or achieving personal goals. It highlights how even small, consistent adjustments lead to remarkable progress over time.

And if $253.08/4 doesn’t fit your exact needs, don’t hesitate to explore other budgeting options. The key is choosing a method that helps you stay committed to your financial goals. Embrace strategies that resonate with you, and over time, you’ll build the foundation for lasting financial health.

Stay in touch to get more news & updates on Forbes Take!